CBSI and Good Return Successfully completed TOC for ACOM Women Savings Group

The Central Bank of Solomon Islands (CBSI) in partnership with Good Return has successfully conducted a five days Training of Coaches (TOC) for the Anglican Church of Melanesia (ACOM) Savings Groups representatives, last week on Monday 16th to Friday 2022, at the LKP Building, Point Cruz.

The TOC which is known as ‘Mekem Seleni Waka for gudfala future,’ is a financial capability coaching program that involves training individuals with knowledge and skills on financial literacy concepts and best practices.

At the end of the program, the Coaches are expected to return to their communities or respective savings groups to teach their family, relatives and members so that they can become financially literate, as well as be competent and confident to make meaningful financial decisions that will improve their daily financial health and welfare.

The program also aimed at complementing the participants current financial literacy levels and capabilities.

Due to the COVID-19 measures and restrictions, only a total of 10 women participated.

Delivering remarks on behalf of the Central Bank of Solomon Islands, Manager of the National Financial Inclusion Unit, Mrs. Linda Folia has applauded the participants for their keen interest and perseverance throughout the training.

“I would like to take this opportunity on behalf of the CBSI to congratulate you all for choosing to be financially aware of money situations around your lives and family, and especially, to become a trained financially competent individual who will assist our people in the communities and our savings group members so that they too become financially aware and competent,” she commended.

Mrs. Folia further conveyed CBSI’s appreciation to Good Return, an Australian NGO for the expertise and support rendered which enabled the successful delivery of the ‘Mekem Seleni Waka for gudfala future’ program.

The TOC involved a 5-day intense training program and embedded a practical based approach. Among other aspects, the TOC focussed on the key expectations and outcomes of the ‘Mekem Seleni Waka for gudfala future’, and the etiquettes of coaching with a specific focus on financial inclusion in Solomon Islands, social inclusion and people with disability.

It also encompassed in-depth learning of significant financial literacy concepts such as money mindfulness, savings, budgeting and understanding existing financial products, while also familiarizing participants with important savings monitoring tools like the money tracker.

The training has also equipped participants with the knowledge on financial capability and behavioural change, as well as how to conduct financial literacy coaching to individuals or members through community and group mobilization.

The final part of the TOC is the practical component. This is when participants will return to their communities, women or savings groups and run a 7 weeks program. During their practical, some of them will be assessed as part of ongoing evaluation and monitoring.

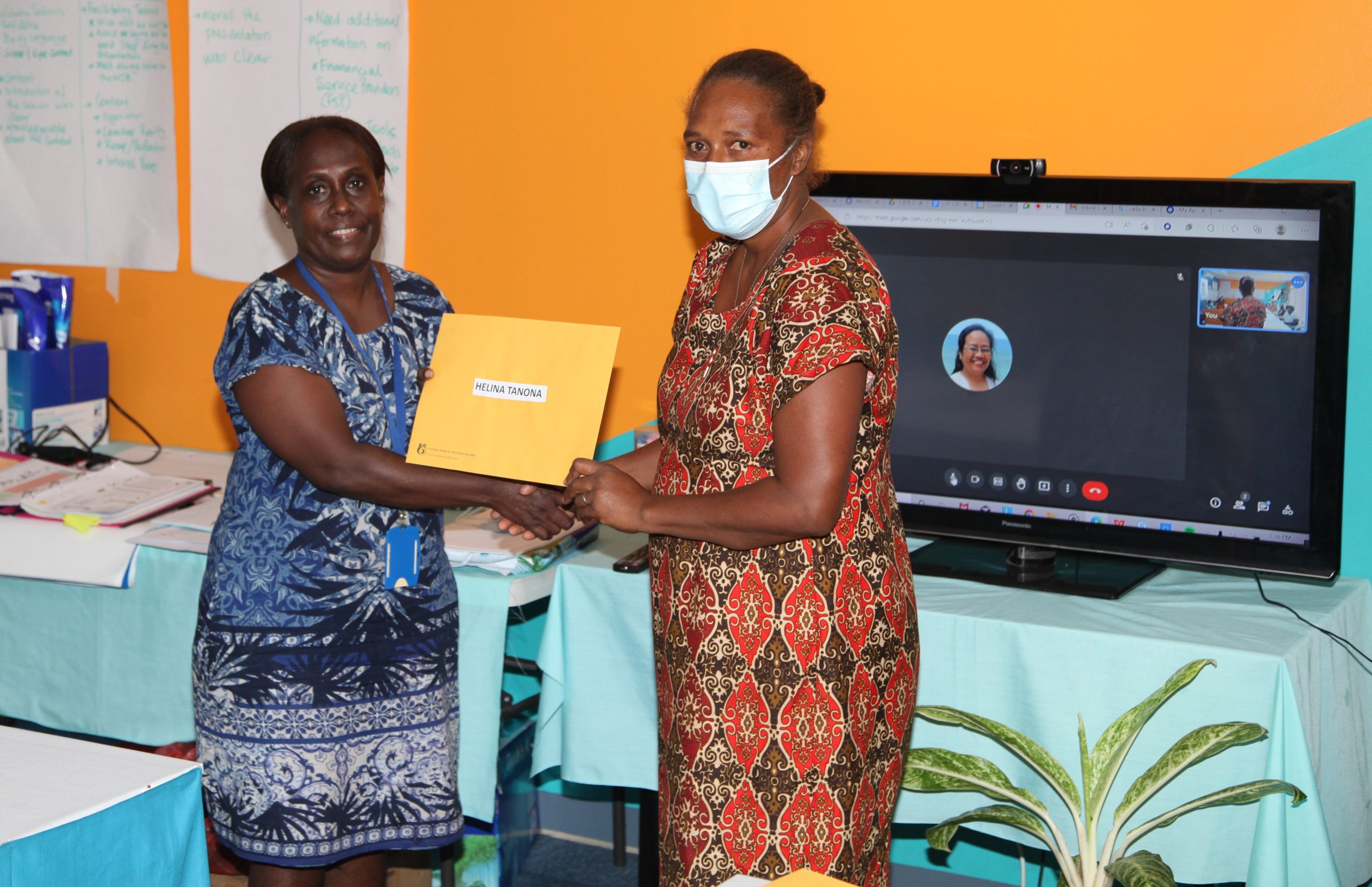

Each participant was presented with relevant materials to assist them during their 7 weeks Coaching program at the conclusion of the graduation.

A key outcome of the training program which Good Return will be looking forward to is the impact that the participants will make in transforming lives when they return to the respective communities.

During the graduation ceremony, participants expressed their gratitude to the facilitators of the program.

“From the ACOM Mothers Union, we are extremely proud of this training which has equipped us with life-skills and knowledge on financial literacy. We have seen that most problems we face nowadays are related to Money. You have done your part and the responsibility is now on us managing the savings group to return to our communities and share the knowledge and skills we learned to help empower our women and members in our communities and the savings groups we represent”, says Mrs. Denise Bako, who is the president of ACOM mother’s union.

Other participants have also shared similar sentiments while also emphasizing the importance of the training for their communities and savings groups.

Mrs. Helina Tanona a participant representing Tasimboko says that she is excited to be part of the program for the first time. She highlighted that the program will assist the grass root men and women and that the concept of money minded she learned from the training will assist her to empower women and people with disabilities in her community.

“I am very excited to learn about the skills and tools on how to make money for a better future. I have observed that most times when our mothers returned from selling their crops/produces at the market, they often spent their money anyhow they want without being mindful,” she said.

“One aspect of the training that challenged me is the need to take care of people with disabilities because they too have the same needs like us,” she added.

Another participant who also lauded the training is Mrs. Rose Theresa Ladoa. She represents a savings group for the widows. Mrs. Ladoa highlighted that she is looking forward to teach her members the “money tracker” a savings monitoring tool she learned from the training. The monitoring tool is to assist them to see how much money is received and spent so that they can save more.

The TOC graduation was capped off with remarks from Mrs. Marlene Dutta, Good Return’s Pacific Program Manager who acknowledged participants for their perseverance all throughout.

“On behalf of Good Return, we congratulate all the Coaches for their engagement, their time and their enthusiasm shown during the training. We are fully committed to delivering quality and practical Financial Capability and Inclusion Programs in the Solomon Islands and your participation greatly helps us achieve this mission,” she commended.

“We wish you all the best as you go back to your homes and share the knowledge you have learnt this week to your families and communities and we are ready to support you to deliver the coaching program,” Marlene concluded.

The program marked the first for this year and as COVID-19 subsides, more training will be conducted for women and youths so that they can transform livelihoods of their respective communities through financial literacy.

Ends//

For more information, please contact:

Central Bank of Solomon Islands | P.O. BOX 634 | Honiara | Ph: (677) 21791 | Email: info@cbsi.com.sb | Website: www.cbsi.com.sb