Solomon islands first ever succesful applicant through cbsi sandbox

The Central Bank of Solomon Islands (CBSI) has admitted ACCountplan Ltd as the nation’s first-ever successful applicant, through its Regulatory Sandbox (RSB) framework, to commence testing its operations and services throughout the country.

ACCountplan Ltd is a locally registered Company, 100% owned by Solomon Islanders with focus on providing professional services to clients and customers. The Company recently applied for Money Transfer Services using the electronic point of sale (ePOS) machine and QR Code for eKYC authentication, through the CBSI Regulatory Sandbox, and following the agreement signing last week with CBSI, the company can now proceed with its operations.

For its Money Transfer Services (MTS), ACCountplan has an established agreement with Freedom Pacific to use its MTS platform – an opportunity to use this service both in-country and abroad. Freedom Pacific’s cross-regional international remittance APP, is registered in New Zealand, with local presence in Tonga, Fiji, Vanuatu and now in Solomon Islands. The platform and services from ACCountplan stand to benefit the local public in terms of sending and receiving money, and is an additional service provider in this space with more convenient options for users.

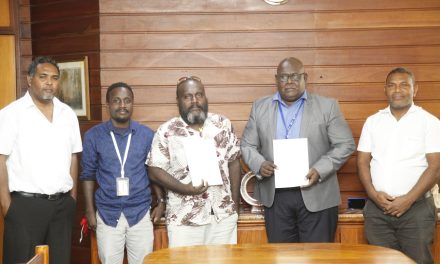

CBSI Deputy Governor, Raynold Moveni was present during the sign off on the agreement with ACCountplan representative Nina Chen, and he expressed his appreciation for the process now moving on to the next level.

“The RSB Agreement with ACCountplan is significant in the sense that it is the first application that has successfully admitted through the CBSI Regulatory Sandbox through to the Testing Phase”, D/Gov Moveni explained.

“We now anticipate greater uptake through to RSB after this successful testing agreement deployment”, he added.

In May of 2023, ACCountplan submitted its application and preliminary assessments commenced thereafter. By 1st June 2023, all assessments were completed and, on the 12th June 2023, work commenced with in-depth evaluation of the application. This went on till July 2023, where a Special Working Group was formed to implement the next stage – the Testing phase of the application as per the RSB.

The Special Working Group decided on the draft agreement, particularly on the terms and conditions, and as specified by the RSB, on the standard operating procedures and guidelines as required.

ACCountplan representative, Nina explained that her company is very happy to be the first to utilize the sandbox for its services, to be trialed.

“We are very happy to be part of this process and we look forward to improving the services on offer, as more people in Solomon Islands join and participate on our platform”, she added.

Key stakeholders in this agreement include, CBSI RSB, ACCountplan and Freedom Pacific. The Testing Agreement was signed by CBSI and ACCountplan on 24th August 2023, allowing a testing period of up to 18 months.

For more information, contact the Central Bank of Solomon Islands (CBSI) on 21791 or Email: info@cbsi.com.sb | Website: www.cbsi.com.sb

Ends//

What is the Regulatory Sandbox (RSB)?

The regulatory sandbox is an innovative and safe space (controlled environment) that facilitates controlled live tests of new financial products and services prior to commercial deployments. It is an important initiative to provide the sandbox environment for interested genuine innovators of FinTech’s, payment service providers, innovative solution providers in MSME financing, agriculture, insurance, savings, credit, investment and wealth generation, sustainable and renewable power generation, mobile money, remittances, payments transfers, tourism and any other priority areas to enable them to experiment under the regulator’s supervision.