Press Release No.5.25 – CBSI Signs Participation Agreement with Aelan Digital Services Limited for Money Transfer Service Testing

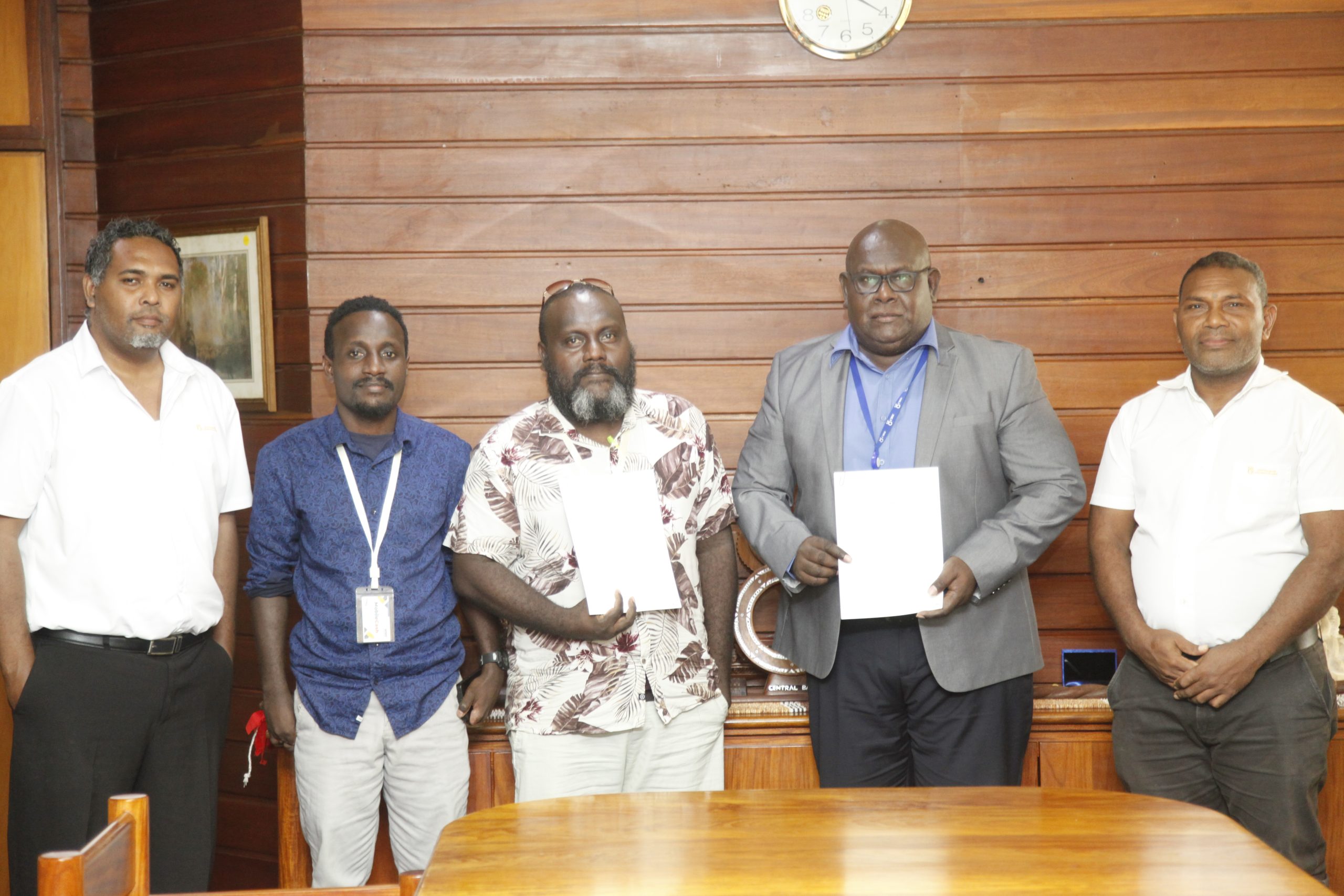

Honiara, Solomon Islands 06.04.25– The Central Bank of Solomon Islands (CBSI), through its Regulatory Sandbox (RSB) framework, has signed a Participation Agreement with Aelan Digital Services Limited (ADSL) to commence testing of a new Money Transfer Service (MTS) solution. The signing was held at the CBSI Board room on Tuesday, 6th of May, 2025.

The agreement sets out the conditions and testing parameters under which ADSL will pilot its innovative remittance service. It is designed specifically for Solomon Islanders, particularly those working abroad as seasonal workers. The MTS solution offers an alternative, locally developed channel for sending money to families and relatives in the country.

Through this partnership, ADSL will undertake an 18-month testing period within the RSB environment. During this time, CBSI will monitor the solution’s viability, scalability, and overall performance. The sandbox approach will also allow regulators to assess any potential risks and evaluate the solution’s fitness and propriety for future deployment in the wider financial system.

CBSI Deputy Governor, Raynold Moveni, welcomed the initiative, stating:

“This collaboration underscores our commitment to harnessing technology to provide seamless and secure financial solutions to Solomon Islanders, empowering them to actively engage in financial transactions and manage their finances with ease and confidence.”

I extend my heartfelt gratitude to our regulatory partners, the assessors and stakeholders for their invaluable support in shaping a more inclusive and adaptive financial ecosystem. Together, we will explore the potential of Aelan Digital services and work towards a brighter future for digital finance. Thank you for being here today,” he said.

In response, ADSL Director, Scrieg Minu, said, ADSL is fully committed to working alongside CBSI.

We thank CBSI for giving us this opportunity to participate in the RSB. We will ensure strict adherence to all requirements and regulations while going the extra mile to ensure our solutions reach and empower even the most rural communities. Financial inclusion is at the heart of our mission, and we are eager to work alongside CBSI to bridge gaps and create opportunities for all Solomon Islanders,” he emphasized.

This is the fifth digital financial service CBSI admitted into the RSB framework.

This initiative aligns with CBSI’s ongoing efforts to support financial inclusion, promote competition, and strengthen the digital financial services landscape in the Solomon Islands.

ENDS//

For more information, contact the Central Bank of Solomon Islands (CBSI) on 21791 or Email: info@cbsi.com.sb | Website: www.cbsi.com.sb

About the Central Bank of Solomon Islands:

The Central Bank of Solomon Islands (CBSI) is the nation’s premier financial institution, responsible for formulating and implementing monetary policy. CBSI oversees and regulates the country’s banking and financial system, ensuring economic stability and growth.